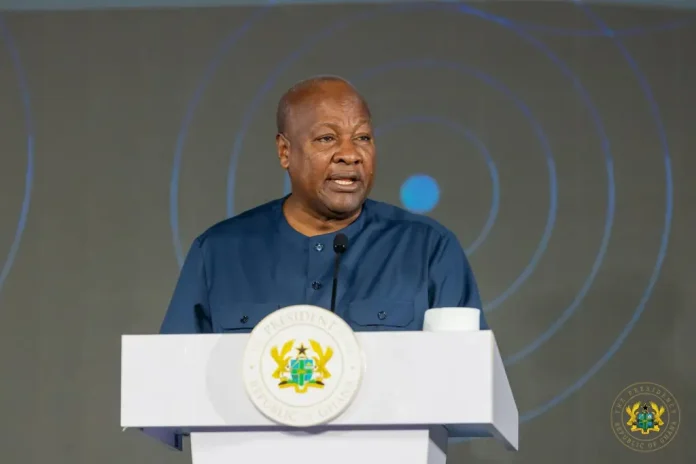

President John Dramani Mahama has signed the COVID‑19 Health Recovery Levy Repeal Act 2025 into law, officially removing the 1% charge on goods, services, and imports that was introduced during the peak of the COVID‑19 pandemic.

The repeal follows Parliament’s approval last month, part of the government’s effort to eliminate “nuisance taxes” and ease the cost of living for households and businesses.

The COVID‑19 Health Recovery Levy was originally enacted in 2021 under Act 1068, imposing a 1% levy on taxable goods, services, and imports, with exemptions aligned with VAT rules. This charge was applied in addition to other consumption taxes, including VAT, the National Health Insurance Levy (NHIL), and the GETFund levy.

With the President’s assent, the repeal will take effect in January 2026, ending the extra 1% levy for both consumers and businesses.